MICHAEL J. DEMPSEY

Personal Information

Tan Duc Thang (TDT) University,

19 Nguyen Huu Tho Street, Tan Phong Ward, District 7,

Ho Chi Minh City, Vietnam

Work e-mail: dempsey@tdtu.edu.vn

Personal e-mail: michaeljosephdempsey008@gmail.com

tel. mobile : +84 9 (Vietnam) (0)1268784523

ORCID: Click to View

Google Scholar: Click to View

Education and qualifications

MBA (major in finance): Strathclyde Business School, University of Strathclyde (1989). Dissertation title: “The behaviour of the stockmarket around the time of the Crash of October 1987, and implications for theories of stockmarket valuation“.

MEng: Department of Petroleum Engineering, Herriot-Watt University, Edinburgh (1979).

PhD: Department of Mathematics, University College, University of Wales (1976).

MSc: Department of Mathematics, Kings College, University of London (1973).

BSc: Department of Mathematics (Upper Second), University of York (1972).

Employment history

2018 – Present: Professor of Finance, Faculty of Finance and Banking, Ton Duc Thang University, Vietnam.

2013 – 2017: Professor at School of Economics, Finance and Marketing, RMIT University. From March 2012: Head of Finance Discipline.

2006 – 2012: Associate Professor: Department of Accounting and Finance, Monash University. From February 2012: Head of Finance Discipline.

1998-2006: Department of Accounting, Finance and Economics, Griffith University.

Associate Professor (from February 2003); Head of School (2003–2004); Head of Finance Discipline and Deputy Head of Department for all campuses (2004–2006).

1990-97: Lecturer in the School of Business & Economic Studies, University of Leeds, UK.

1983-90: “Reservoir Engineer”, BP Oil Company, London, Egypt, Qatar Holland (commissioning and on-site supervision of reservoir testing programmes; computer modelling of oil and gas fields; analysis of reservoir test data; design and implementation of BP “teaching” programmes).

1981-83: “Field Engineer”, ARAMCO Oil Company, Saudi Arabia

1979-81: “Reservoir Engineer”, Britoil Oil Company, Glasgow, UK (computer modelling of oil reservoirs, interpretation of well test data).

1977-78: “Research Fellow”, University of Strathclyde, Glasgow, UK (computer modelling of fluid flow and condensation of steam).

Sole-authored books

Academic:

- Stock Markets, Investments and Corporate Behavior: A Conceptual Framework of Understanding (2016), by Michael Dempsey (Imperial College Press with World Scientific, isbn hardcover: 978-1-78326-699-9).

Textbooks:

- Stock markets and Corporate Finance (2017), by Michael Dempsey (World Scientific Press), isbn: 978-1-78634-325-3 (hardcover), isbn: 978-1-78634-326-0 (softcover), with Complete with videos of myself summarizing each of the chapters.

- Investment, Portfolio Theory and Management, by Michael Dempsey (Routledge, forthcoming.

Articles in Refereed Journals

(most recent ERA rankings in parenthesis)

Hoang, C. T. and Dempsey M. (2018), “The Effect of the New Corporate Accounting Regime on Earnings Management: Evidence from Vietnam”, Journal of International Studies, forthcoming.

Mozumder, S., Kabir, M. H. and Dempsey, M. (2018), “Pricing and Hedging Options with GARCH-stable Proxy Volatilities”, Applied Economics incorporating Applied Financial Economics, forthcoming. (A)

Mozumder, S., Choudhry, T. and Dempsey, M. (2018), “Spectral Measure of Risk for International Futures Markets: A Comparison of Extreme Value and Lévy Models”, Global Finance Journal, Vol. 37, pp. 248-261. (B)

Dempsey, M., Gunasekarage, A. and Truong, T. (2018) “The Association between Dividend Payouts and Firm Growth: Australian Evidence”, Accounting and Finance, forthcoming. (A)

Dempsey, M. (2018), “Discounting Methods and Personal Taxes”, European Journal of Management, forthcoming. (A)

Tanha, H., Dempsey, M. and Labeb, M. (2018), “Derivative Usage by Australian Industrial Firms: Pre-, During and Post-GFC”, Review of Economics and Finance, Vol. 11, No. 1, pp. 31-39. (C)

Li, M. and Dempsey, M. (2018), “The Fama and French Three-factor Model in Developing Markets: Evidence from the Chinese Markets”, Investment Management and Financial Innovations, Vol. 15, No. 1, pp. 46-57. (C)

Alawadhi, A. M. and Dempsey, M. (2017), “Social Norms and Market Outcomes: The Effects of Religious Beliefs on Stock Markets”, Journal of International Financial Markets, Institutions & Money, Vol. 50, pp. 119-134. (A)

Mozumder, S., Kabir, M. H. and Dempsey, M. (2017), “Do Coherent Risk Measures Identify Assets Risk Profiles Similarly? Evidence from International Futures Markets”, Investment Management and Financial Innovations, Vol. 14, No. 3, pp. 361-380. (C)

Dempsey, M. and Li, M. (2017), “Is Post Earnings Announcement Drift a Priced Risk Factor in Emerging Markets: Chinese Evidence”, Archives of Business Research (ABR), Vol. 5, No. 6, pp. 29-47.

Tanha, H. and Dempsey, M. (2017), “Derivatives Usage in Emerging Markets following the GFC: Evidence from the GCC Countries,” Emerging Markets Finance and Trade, Vol. 53, pp. 170-179. (B)

Li, M. and Dempsey, M. (2017), “Value, Growth and Divergence of Opinion in Emerging Markets: Chinese Evidence,” Archives of Business Research (ABR), Vol. 5, No. 5, pp. 72-93.

Mozumder, S., Dempsey. M. and Kabir, M.H. (2017) “Back-testing Extreme Value and Lévy Value-at-Risk Models: A Comparison for International Futures Markets,” The Journal of Risk Finance, Vol. 18, No. 1, pp. 88-118. (B)

Cheong C., Dempsey, M. and Xie. H.M. “Political Skill, Entrepreneurial Orientation and Organizational Justice: A Study of Entrepreneurial Enterprise in China,” International Journal of Entrepreneurial Behavior & Research forthcoming. (B)

Sharif, M., Dempsey, M., Choudhry, T. and Kabir, M.H. (2016), “An Improved Framework for Approximating Option Prices with Application to Option Portfolio Hedging,” Economic Modelling, vol. 59, pp. 285-296. (A)

Watson J., Delaney, J., Dempsey, M. and Wickramanayake, J. (2016), “Australian Superannuation (Pension) Fund Product Ratings and Performance: A Guide for Fund Managers,” Australian Journal of Management, Vol. 41, No. 2, pp. 189-211. (A)

Tanha, H. and Dempsey, M. (2016), “The evolving dynamics of the Australian SPI 200 Implied Volatility Surface” Journal of International Financial Markets, Institutions & Money, Vol. 43, pp. 44-57. (A)

Tanha, H. and Dempsey, M. (2016), “The Information Content of ASX SPI 200 Implied Volatility,” Review of Pacific Basin Financial Markets and Policies, Vol. 19, No. 1, pp. 1-14. (B)

Tanha, H. and Dempsey, M. (2016), “Derivatives Usage in Emerging Markets following the GFC: Evidence from the GCC Countries,” Emerging Markets Finance and Trade, forthcoming. (B)

Edirisuriya, P., Gunasekarage, A. and Dempsey M. (2015), “Bank Diversification, Performance and Stockmarket Response: Evidence from Listed Public Banks in South Asian Countries”, Journal of Asian Economics, Vol. 41, pp. 69-85. (A)

Abraham, M, Dempsey, M. and Marsden, A. (2015), “Dividend Re-investment Plans (DRPs): A Tax-based Incentive under the Australian Imputation Tax System,” Australian Tax Forum, Vol. 30, No. 2, pp. 435-453. (A)

Dempsey, M., Edirisuriya, P. and Gunasekarage, A. (2015), “Australian Specific Bank Features and the Impact of Income Diversification on Bank Performance and Risk,” Australian Economic Papers, Vol. 54, No. 2, pp. 63-87. (B)

Shi, X., Dempsey, M., Duong, H. and Kalev, P. (2015), “Investor Protection and Market Liquidity Revisited,” Corporate Governance: The International Journal of Business in Society, Vol. 15, No. 4, pp. 517-529. (C)

Tanha, H. and Dempsey, M. (2015). “Do Aussie Markets Smile? Implied Volatility Functions and Determinants,” Applied Economics, Vol. 47. No. 30, pp. 3143-3163. (A)

Chen, D., Dempsey, M. and Lajbcygier, P. (2015), “Is Fundamental Indexation able to time the market? Evidence from the Dow Jones Industrial Average & the Russell 1000,” Journal of International Financial Markets, Institutions & Money, Vol. 37, pp. 162-177 (A)

Tanha, H. and Dempsey, M. (2016), “The Impact of Macroeconomic Information Releases on the Smile Shape: Evidence from the Australian Options Market,” Review of Behavioral Finance, Vol. 8, No. 1, pp. 80-90. (B)

Tanha, H. and Dempsey, M. (2015), “The Asymmetric Response of Volatility to Market Changes and the Volatility Smile: Evidence from Australian Options,” Research in International Business and Finance, Vol. 34, pp. 164-176. (B)

Dempsey, M., Shi, X.T. and Irlicht, L. (2015), “Fundamental Indexation and the Fama-French Three Factor Model: Risk Assimilation or Stock Mispricing?” Journal of Investment Management (JOIM), Vol 13, No. 4, 57-70. (C)

Dempsey, M. (2014), “The Modigliani and Miller (MM) Propositions: The History of a Failed Foundation for Corporate Finance?” Abacus, Vol. 50, No. 3, pp. 279-295. (A)

Tanha, H., Dempsey, M. and Hallahan, T. (2014), “Macroeconomic Information and Implied Volatility: Evidence from Australian Index Options,” Review of Behavioral Finance, Vol. 6, No. 1, pp. 46-62. (B)

Gharaibeh, O., Bornholt, G. and Dempsey, M. (2014), “Evidence of Industry Cost of Equity Estimation,” The International Journal of Business and Finance Research, Vol. 8, No. 4, pp. 1-15. (C)

Dempsey, M. (2013), “Consistent Cash Flow Valuation with Tax-Deductible Debt: A Clarification,” European Financial Management, Vol. 19, No. 4, pp. 830-836. (A)

Dempsey (2013), “The CAPM: A Case of Elegance is for Tailors?” Abacus, Vol. 49 (S1), pp. 82-87. (A)

Dempsey, M. (2013), “The Capital Asset Pricing Model (CAPM): The History of a Failed Revolutionary Idea in Finance,” Abacus, Vol. 49 (S1), pp. 7-23. (A)

The above paper was selected as the joint winner of the 2013 Abacus Best Manuscript Award; the paper also appears in “Behavioural and Experimental Finance (editor’s choice)” eJournal for SSRN, Vol. 4, No. 22, June, 2013.

Dempsey (2012), “The Controversy in Fundamental Indexation: Why both sides of the argument are (mostly) correct,” Journal of Investment Management (JOIM), Vol. 10, No. 4, pp. 54-63. (C)

Bollen, B., Dempsey, M. and Li, L. (2011), “Beta in the Chinese Markets: Wanted Dead or Alive,” Corporate Ownership and Control, Vol. 8, No. 4, pp. 305-312. (B)

Cai, S., Balachandran, B. and Dempsey, M. (2011), “The Financial Profiles of Takeover Target Firms and their Predictibility: Australian Evidence,” Corporate Ownership and Control, Vol. 8, No. 3, pp.567-584. (B)

Dempsey, M. (2011), “Idiosyncratic Volatility as an Explanation for the Small Firm Effect: Australian Evidence,” Corporate Ownership and Control, Vol. 8, No. 3, pp. 280-289. (B)

Dempsey, M., McKenzie, M. and G. Partington (2010), “The Problem of Pre-Tax Valuations: A Note,” The Journal of Applied Research in Accounting and Finance, Vol. 5, No. 2, pp. 10-13. (B)

Bollen, B. and Dempsey, M. (2010), The Small Firm and Other Confounding Effects in Asset Pricing Data: Evidence from Australian Markets,” Investment Management and Financial Innovations, Vol. 7, No. 4, pp. 70-76. (C)

Dempsey, M. (2010), “The Book-to-Market Equity Ratio as a Proxy for Risk: Evidence from Australian Markets,” Australian Journal of Management, Vol. 7, No. 1, pp. 7-21. (A)

Dempsey, M. (2009), “Rankings for Australian Managed Funds: Contrariness and Performance Index Failure,” Journal of Asset Management, Vol. 10, pp. 138-157. (B)

Dempsey, M. (2009), “The Fama and French Three-factor Model and Leverage: Compatibility with the Modigliani and Miller propositions,” Investment Management and Financial Innovations, Vol. 6, No. 1, pp. 48-53. (C)

Dempsey, M. and G. Partington (2008) “The cost of Capital Equations under the Australian Imputation tax System,” Accounting and Finance, Vol. 48, pp. 439-460. (A)

Bollen, B., Clayton, L., Dempsey, M. and M. Veeraraghavan (2008) “Are Company Size and Stock Beta, Liquidity and Idiosyncratic Volatility related to Stock Returns? Australian Evidence,” Investment Management and Financial Innovation, Vol. 5, No. 4, pp. 143-156. (C)

Dempsey, M. (2008) “The Significance of Beta for Stock Returns in Australian Markets,” Investment Management and Financial Innovation, Vol. 5, No. 3, pp. 51-61. (C)

Dempsey, M. (2003), “A Multidisciplinary Perspective on the Evolution of Corporate Investment Decision Making,” Accounting, Accountability and Performance, Vol. 9, No. 1, pp. 1 – 33. (C)

Dempsey. M. (2002), “The Nature of Market Growth, Risk and Return,” Financial Analysts Journal, Vol. 58, No. 3, pp. 45-59. (A)

Dempsey, M. (2001), “Investor Tax Rationality and the Relationship between Dividend Yield and Equity Returns: An Explanatory Note “, Journal of Banking and Finance, Vol. 25, No. 9, pp. 1681–1686. (A*)

Dempsey, M. (2001), “Valuation and Cost of Capital Formulae with Corporate and Personal Taxes: A Synthesis Using the Dempsey Discounted Dividends Model “, Journal of Business Finance and Accounting, Vol. 28, Nos. 3 & 4, pp. 357-378. (A)

Dempsey, M. (2000), “Ethical Profit: An Agenda for Consolidation or for Radical Change”, Critical Perspectives on Accounting, Vol. 11, pp. 531-548. (A)

Hudson, R., Keasey, K., Littler, K. & Dempsey, M. (1999), “Time Diversification: An Essay in the Need to Revisit Finance Theory”, Critical Perspectives on Accounting, Vol. 10, pp. 501-519. (A)

Dempsey, M. (1998), “The Impact of Personal Taxes on the Firm’s Weighted Average Cost of Capital and Investment Behaviour: A Simplified Approach Using the Dempsey Discounted Dividends Model”, Journal of Business Finance and Accounting, Vol. 25, Nos. 5 & 6, pp. 747-763. (A)

Dempsey, M. (1998), “Capital Gains Tax: Implications for the Firm’s Cost of Capital, Share Valuation and Investment Decision-Making”, Accounting and Business Research, Vol. 28, No. 2. pp. 91-96. (A)

Hudson, R., Keasey, K. & Dempsey, M. (1998), “Share Prices under Tory and Labour Governments in the Post 1945 UK”, Applied Financial Economics, Vol. 8, pp. 389-400. (B)

Dempsey, M. (1996), “The Cost of Equity Capital at the Corporate and Investor Levels Allowing A Rational Expectations Model with Personal Taxations”, Journal of Business Finance and Accounting, Vol. 23, No. 9&10, pp. 1319-1331. (A)

Dempsey, M., Hudson, R., Littler, K. & Keasey, K. (1996) “On the Risk of Stocks in the Long Run: A Resolution to the Debate?” Financial Analysts Journal, Vol. 52, No. 5, pp. 57-62. (A)

Dempsey, M. (1996), “Corporate Financial Management: Time to Change the Cost of Capital Paradigm?”, Critical Perspectives on Accounting Vol. 7, No. 6, pp. 617-639. (A)

Hudson, R., Dempsey, M. & Keasey, K. (1996), “The Weak Form of Efficiency of Capital Markets: The Application of Simple Technical Trading Rules to the UK Stock Markets: 1935-94”, Journal of Banking and Finance, Vol. 20, No. 6, pp. 1121-1132. (A*)

Dempsey, M. (1991), “Modigliani and Miller Revisited: The Cost of Capital with Unequal Borrowing and Lending Rates”, Accounting and Business Research, Vol. 21, No. 83, pp. 221-226. (A)

Crossland, M., Dempsey, M. & Moizer, P. (1991), “The Effect of Cum- to Ex-dividend Changes on UK Share Prices”, Accounting and Business Research, Vol. 22, No. 85. pp. 47- 55. (A)

Al-Dolami, A M., Berta, D., Dempsey, M. & and Smith, P.J. (1989), Evaluating the Trace Response of a Waterflood Five Spot Pilot: Dukhan Field, Qatar”, Society of Petroleum Engineers, SPE No. 17989, pp. 641-658.

Dempsey, M. & Nicol, A. A. (1982), “Condensation of Wet Steam on a Horizontal Tube with Additional Droplet Depositions”, International Journal of Multiphase Flow, Vol. 8, No. 3, pp. 207-216.

Dempsey, M. & Wickramasinghe, N.C. (1975), “The Plausibility of Silicate-core with Ice-mantle Grains in Interstellar Space”, Astrophysics and Space Science, Vol. 34, pp.185-189.

Wickramasinghe, N.C. & Dempsey, M. (1974), “Mean Free Path Limitation of Conduction Electrons and Extinction Efficiencies of Graphite Grains”, Astrophysics and Space Science, Vol. 30, pp. 315-325.

Professional journals:

Al-Dolami, A M., Berta, D., Dempsey, M. & and Smith, P.J. (1989), “Evaluating the Trace Response of a Waterflood Five Spot Pilot: Dukhan Field, Qatar”, Society of Petroleum Engineers, SPE No. 17989, pp. 641-658.

Contributions to Books

(1) In Research Handbook of Investing in the Triple Bottom Line (edited by Sabri Boubaker, Douglas Cumming and Duc Khuong Nguyen), Edward Elgar publishing: “Financial Instability: Economic and financial perspectives”, Chapter 5, Dempsey, M (ISBN: 9781786439994)

(2) In Routledge Companion to Financial Accounting Theory (2015) (edited by Stewart Jones), “Financial Measurement and Financial Markets”, Chapter 17, Dempsey, M and Jones, S. (isbn: 978-0415-66028-0 hbk; 978-0203-07425-1 ebk).

(3) Fundamentals of Corporate Finance published by Wiley (2103, 2nd ed.) (with Robert Parrino, David Kidwell, Hue Hwa Au Yong, Nigel Morkel-Kingsbury, Samson Ekanayake, Jennifer Kofoed, and James Murray)

In Handbook of Cost and Management Accounting (2005) (edited by Zahirul Hoque), (Spiramus, London). Three chapters:

(i) “A Multidisciplinary Perspective on the Evolution of Corporate Investment Decision Making”,

(ii) “Ethical Profit: An Agenda for Consolidation or for Radical Change”,

(iii) “Corporate Financial Management: Time to Change the Cost of Capital Paradigm?”

Attainment of Competitive Research Grants

- The Australian Centre for Financial Studies: Tony Naughton Memorial Award Grant ($10,000) for the project “The Australian Imputation Tax System, Dividend Policy, Earnings Growth and Market Returns: an Australian Study” (with Thanh Tan Truong).

- The Australian Centre for Financial Studies: “Dividend policy, Corporate Ownership, Earnings Growth and Market Returns: an Australian Study” for $10,000 (with Thanh Tan Truong).

- The Australian Centre for Financial Studies: “Diversification and Performance: the Recent Experience of Australia’s Banks” for $5,000 (with Abey Gunasekarage and Piyadasa Edirisuriya at Monash University).

- ARC Linkage Grant, 2009: I was the chief investigator of this linkage grant: funding for $165,000 over 2009-2012: “An Empirical Examination of Non-Market Capitalisation Weighted Indices in Australia” (with Madhu Veeraraghavan, Paul Lajbcygier, Robert Faff and industry partners of Victoria Funds Management Corporation (VFMC)). I was also the main supervisor for the current PhD candidate funded by this project.

- Joint Recipient of DIIRD (Department of Innovation, Industry and Regional Development) grant , 2008: I successfully negotiated consultancy with Invest Victoria (with Madhu Veeraraghavan and Jay Wickramanayake):“Inward Direct Foreign Investment (FDI) into the State of Victoria: Improving the Quality of Investment Project Reporting,” with budget for $45,000.

- Australian Centre for Financial Studies, 2010: Chief Investigator of research grant for “Rankings for Australian Managed Funds: A case of Performance Index Failure?” for $6,000.

- Melbourne Centre for Financial Studies, 2007: Recipient of research grant for “The Evidence for Fundamental Indexation,”for $11,000.

- Melbourne Centre for Financial Studies, 2006: Chief Investigator of research grant for “Alternative Risk Indices for the Mutual Fund Industry,” for $11,000.

- Melbourne Centre for Financial Studies, 2006: Chief Investigator of research grant for “Towards a Reconciliation of Portfolio Theory and Empirical Outcomes in Stock Price Behaviour: Australian Evidence,” for $10,000.

- LaTrobe University Grant, 2006: Recipient of research grant for “Is Beta alive in China?” for $3,500.

- Griffith University Research Grant Scheme, 2001: Nominated Chief Investigator of: “An Investigation of the Decision-Making Processes of Fund Managers and their Impact on Share Prices,” for $7,735.

Social Science Research Network

I register in the top 10%.

Links to published and working papers: http://ssrn.com/author=85137

Academic Journal Refereeing conducted for:

Abacus,

Journal of Banking and Finance,

European Financial Management,

Accounting and Business Research,

Journal of Applied Finance,

Accounting and Finance,

Critical Perspectives on Accounting

The British Accounting Review,

Journal of Economic Behavior and Organization,

International Journal of Entrepreneurial Behavior and Research

Australian Centre for Financial Studies (ACFS): Research Grants Panel (2014)

Board member of ACFS (Australia Centre for Financial Studies), 2013-2015.

ACFS Research Grants Panel responsible for assessment and allocation of research funds ($70,000).

Research Supervision

Supervision of PhD students:

- Main Phd Supervisor for: Abdullah Alawadi: “The Liquidity Premium for Islamic Stocks”, awarded 2017.

- Phd Supervisor for Nirav Parikh: “Three Essays on IPOs in the context of India” (with Monica Tan), awarded 2017.

- Phd Supervisor for Somaiyah Alalmai: “Robust and Fragile Determinants of Capital Structure-International Evidence” (with Imad Moosa), awarded 2017.

- Phd Supervisor for student Ahmad Yousef: “Financial and operational Hedging of Exposure to Foreign Exchange Rate Risk: A GCC perspective” (with Imad Moosa), awarded 2016.

- Phd Supervisor for student Xingnan Jiang: “The causes and consequences of operational risk: some empirical tests” (with Imad Moosa), awarded 2016.

- Main Phd Supervisor for Terry Shi,: “An Empirical Examination of Non-Market Capitalisation Weighted Indices in Australia”, awarded 2014.

- Single Phd Supervisor for Hassan Tanha: “Derivative Pricing in Australian Markets”, awarded 2011.

- Main Phd supervisor for Man Li: “Factors of Asset Pricing in Chinese Markets”, awarded 2011.

- External Phd Supervisor for Mirela Malin: “Issues in Market Level Return Predictability”, awarded 2009.

- Phd Supervisor for Larry Li: “Corporate Governance and Initial Public Offerings in China”, awarded 2006.

- Phd Supervisor for Martin Hovey: “The Role of Corporate Governance in Firm Performance: the Case of China”, awarded 2005.

- Phd Supervisor for Madhu Veeraraghavan: “Multi-factor Model Explanations for Selected Stock Market Performances in the Asia Pacific Rim”, awarded 2001.

Examiner for PhD theses at:

- University of Sydney – “Tax Minimization and Arbitrage in a Competitive Statics and General Equilibrium Setting”, by Keith Woodward, 2018.

- University of Rennes – “Machine Learning and Applications: New Models to predict Bankruptcy of Banks”, by Hong Hanh Le, 2018.

- Edith Cowan University – “An Investigation into the Volatility and Co-integration of Emerging European Stock Markets,” by Anna Golab, 2013.

- University of Auckland– “Dividend Reinvestment Plans: Evidence from the Australian Market,” by Matthew Abraham, 2012.

- University of Sydney – “Doubling Time in Finance,” by Richard Philip, 2011

- LaTrobe University – “An Empirical Investigation into the Working of an Emerging Stock Market: The Case of Kuwait,” by Sulaiman Al-Abduljader, 2009.

- The University of Sydney – “Alternative Estimates of the Cost of Capital and the Impact of Imputation Tax Credits on CAPM Estimates – An Australian Study,” by Giang Truong, 2007.

- University of Technology Sydney (UTS) – “The Value of Dividends in Australia,” 2004.

- University of Leeds (UK) – “Initial Public Offerings in Hong Kong,” 1994.

Supervision and Co-Supervision of Honours Students (Monash University):

- “The Return Performance of Dual-listed IPOs in China,” 2012, by Menghan Zhang (with Zoltan Murgulov).

- “Does Financial Sponsorship Matter in an IPO Market: Evidence from China,” 2012, by Weili Kong (with Zoltan Murgulov).

- “Fundamental Indexation: Passive or Active Investment?” 2010, by Shi Chen (with Paul Lajbcygier).

- “Investor Protection and Stock Market Liquidity: Evidence from Hong Kong,” 2009, by Terry Shi (with Petko Kalev).

- “Determinants of Take-Over Bids and the Potential for Abnormal Returns: Australian Evidence,” 2008, by Shu Wen Cai.

- “The Long-run Performance of IPOs in Resources Companies,” 2007, by Tom Guan

- “The underpricing phenomenon of Initial Public Offerings in Australia: Is Money Left on the Table?” 2007, by Yongjian Hung.

- “Are company Size and Stock Beta, Liquidity and Idiosyncratic Volatility related to Stock Returns? Australian Evidence,” 2006, by Louise Clayton.

- “Is Downside Beta Prices Over Bull and Bear Market Conditions? An Evaluation of the Australian Capital Market,” 2006, by Niv Dagan.

Papers Presented at Conferences

Paris Financial Management Conference, Paris, Dec 2017. “The dividend payout versus growth controversy” (with Abey Gunasekarage and Thanh Truong).

The World Finance Conference, Sardinia, Italy, July 2017. “The Association between Dividend Payout and Frim Growth: Australian Evidence” (with Thanh Truong).

The 7th International Research Meeting in Business and Management, Nice, 2016. “Financial Markets: pricing and Modeling”.

Paris Financial Management Conference, Paris, Dec 2015. “Do Special Dividends Convey Information? The UK Experience” (with Bala Balachandran).

The 6th Conference on Financial Markets and Corporate Governance, Perth, 2015. “The Association between Dividend Payouts and Firm Growth in Australia: Do the bad apples contaminate the good?” (with Tan Truong)

The 22nd Annual conference of the Multinational Finance Society, Prague, Czech Republic, June, 2014. “Fundamental Indexation and the Fama-French three factor model: risk assimilation or stock mispricing?”

European Financial Management Annual conference, Henley Business School, University of Reading, UK. 2013. “Macroeconomic information and implied volatility: evidence form Australian index options,” (with Terrence Hallahan and Hassan Tanha).

3rd Conference on Financial Markets and Corporate Governance. Melbourne. 2012. “The Fama and French Three-factor Model: Chinese Evidence,” (with Man Li and Madhu Veeraraghavan).

Macao International Symposium on Accounting and Finance, Macao 2011. “A spread-sheet approach to teaching discounting methods of valuation (as a form of problem- and action-based learning).”

Finance and Corporate Governance Conference, Melbourne 2010, “The financial profiles of takeover target firms and their takeover predictability: Australian evidence” (with Bala Balachandra).

MidWest Finance Association, Las Vegas, 2010, “Idiosyncratic Volatility as an Explanation of the Small Firm Effect: Australian Evidence.”

The Australasian Finance and Banking Conference, Sydney, 2009, “Investors’ Protection and Market Liquidity: Evidence from Hong Kong” (with Petko Kalev, Xiaofeng Shi, Huu Nhan Duong); and “Special Dividend Announcements: Signaling or Free Cash Flow Hypothesis? Evidence from UK Firms” (with Bala).

The 12th Banking and Finance Conference, Melbourne, 2007, “Are Beta, Firm Size, Liquidity and Idiosyncratic Volatility Related to Stock Returns? Australian Evidence.”

The Asian Financial Association Conference, Auckland, 2006, “Market Risk and Return as a Self-Regulating Process: Alternative Paradigms.”

The International Conference on Simulation and Modelling (SimMod), Bangkok, January, 2005: “A Binomial Model Approach to Modelling Portfolio Volatility in Continuous Time;” and “Portfolio Investment Allocation Allowing Volatile Growth in Continuous Time”.

The Accounting Association of Australia and New Zealand (AAANZ) Conference, Alice Springs, June, 2004: “The Set of Cost of Capital Equations under the Australian Imputation Tax System”.

The 15th Annual Australian Finance and Banking Conference, Sydney, Australia, December, 2002: “The Interplay of Stocks, Bonds and Cash in Portfolio Selection”.

Asian Pacific Finance Association (APFA) Conference, Bangkok, July 2001: “Pricing Derivatives in the Context of Personal Taxes: A Generalised Framework” Also discussant at “Derivatives Modelling” session.

The 12th PACAP Financial Management Association (FMA) Conference, Melbourne, July, 2000: “The Cost and Allocation of Capital in the Context of the Australian Imputation Tax System: A Generalised Framework”.

The Accounting Association of Australia and New Zealand (AAANZ) Conference, Hamilton Island, June, 2000: “The Weighted Average Cost of Capital (WACC) Applied to Investment Decision Making in the Context of an Imputation Tax System”.

The 12th Annual Australian Finance and Banking Conference, Sydney, Australia, December, 1999: “The Market Risk Premium (ex ante): An Analytical Approach”.

Critical Perspectives in Accounting Symposium, New York, U.S.A., April 1999: “Ethics in Finance: An Agenda for Consolidation or for Radical Change”.

British Accounting Conference, Glasgow U.K., March 1999: “Corporate Investment Decision Making: An Historical Perspective”.

The 11th Annual Australian Finance and Banking Conference, Sydney, Australia, December, 1998: “Perspectives on Corporate Investment Decision Making: An Historical Survey”, and “An Integrated Set of Valuation and Cost of Capital Expressions for Corporate Investment Decision-Making”.

British Accounting Conference, Manchester, U.K., April 1998: “Investment Appraisal: The case for ‘Middle Range’ Thinking and Functional Research” (with Elaine Harris).

Financial Management Association International, New Orleans, USA, October, 1996: “A Unified Integration of Financial Cost of Capital Expressions Allowing A Straightforward ‘Dividend Discount Model’ with Personal Taxations”.

Critical Perspectives in Accounting Symposium, New York, U.S.A., April 1996: “Corporate Financial Management: Time to Change the Cost of Capital Paradigm?”

British Accounting Conference, Cardiff, U.K., March 1996: “The Development of a Theory of Corporate Financial Investment Decision Making: An Historical Perspective”.

Summary of Outstanding Achievements in Research

- Synopsis of research output:

I have summarized my academic work as:

Stockmarkets, Investments and Corporate Behavior: A Conceptual Framework of Understanding (2016), by Michael Dempsey (Imperial College Press with World Scientific, isbn hardcover: 978-1-78326-699-9).

In addition, I have a record of single-authored publications that contribute to the essential theoretical underpinnings of finance. My work has appeared in leading international journals, including, Journal of Banking and Finance (2), Financial Analysts Journal (2), European Financial Management (1), Abacus (3), Journal of Investment Management (2), Australian Journal of Management (2), Journal of Business Finance and Accounting (3), Accounting and Business Research (3), Critical Perspectives on Accounting (3), Journal of Asset Management (1), and Accounting and Finance (1).

In total (following the most recent Australian ERA rankings), I have 2 A*-ranked papers, 30 A-ranked papers, 14 B-ranked papers, and 12 C-ranked papers (plus two in Astrophysics, one in fluid engineering, and one in Petroleum Engineering) (a total of 60 refereed papers).

An over-arching feature of my research is that it is devoted to developing theory at the core of my discipline area. The concentration of this work reflects my focus on three prevailing themes:

the cost of capital: the concept of the cost of capital represents the key driver of financial decision-making: corporate finance (valuing projects), investment finance (valuing shares), as well as for the regulation of utilities (setting fair prices in accordance with the cost of capital). As such, it determines the level at which the economy may grow. I have contributed to an understanding of the cost of capital in the context of personal taxes in a series of theoretical articles with reference to Dempsey’s Dividend Discount Model (three papers in Journal of Business Finance and Accounting; one in Accounting and Finance – in which, with Graham Partington, my model provides a solution to the problem of calculating the cost of capital with reference to Australia’s distinctive “imputation” tax system; one in European Financial Management; and one in Accounting and Business Research). Recognising my authority on the cost of capital, I have been invited as a key speaker at “Estimating the Cost of Capital: CAPM variants and alternatives,” 16/10/2009: a presentation for industry regulators, as well as invitations to subsequent colloquia.

risk and return: the cost of capital – and, indeed, the foundations of financial thinking – ultimately derive from the trade-off between risk and return. In the prestigious Financial Analysts Journal, I propose a radical model of share price formation that shows how “risk might create its own reward.” In the paper, the model is referred to as Dogma (Dempsey’s organic growth model of appreciation). In my (single-authored) paper in Journal of Investment Management, I argue that the underlying explanation for the much-acclaimed phenomenon of fundamental indexation (a controversial alternative to market capital-weighted indexation (which is the focus of my current ARC industry linkage grant, see below) can be attributed to insights incorporated in the Dogma paper.

re-direction of corporate and investment finance foundations: In three papers in Critical Perspectives on Accounting (two single-authored, one with Kevin Keasey and Robert Hudson), and more recently three (single-authored) papers in Abacus, I question the adherence to a quantitative prescriptive foundation for financial theory, and, thereby, the meaningfulness of the current agenda of empirical research in asset pricing. Recognition of this work and its potential impact is attested by a special issue of the ‘A’ journal Abacus that has been dedicated to a discussion of my recent work with invited responses from acclaimed academics at the top of their field (including Imad Moosa, Avanidhar Subrahmanyam, Phil Brown, Tom Smith, Robert Faff, Terry Walter, Henk Berkman, and Kevin Keasey). I followed this with two more articles in Abacus that take a critical perspective of the foundations of modern finance theory.

- Research accolades received:

Ranked number 4 in Australia and New Zealand:

In a SIRCA (Securities Industry Research Centre of Asia-Pacific) 2005 survey, I was ranked 4th in Australia and New Zealand.

Independently ranked number 232 worldwide:

In a US survey summarised in Financial Management (2002 Winter issue), I was ranked 232 worldwide.

Dempsey, M. (2013), “The Capital Asset Pricing Model (CAPM): The History of a Failed Revolutionary Idea in Finance,” Abacus, Vol. 49 (S1), pp. 7-23. (A)

The above paper was selected as the joint winner of the 2013 Abacus Best Manuscript Award; the paper also appears in “Behavioural and Experimental Finance (editor’s choice)” eJournal for SSRN, Vol. 4, No. 22, June, 2013.

Summary of Outstanding Achievements in Teaching

My textbook: Stock markets and Corporate Finance (2017), by Michael Dempsey (World Scientific Press), offers an introductory explanation of core precepts and foundation hypotheses in financial theory.

Additionally, I have co-authored the finance textbook (in its second edition): Fundamentals of Corporate Finance published by Wiley (2nd ed.) in 2013. This text relates finance theory to the reality of institutional arrangements, and is aimed at providing a realistic educational framework for students as would-be practitioners.

At Griffith University, I actively promoted the installation and subsequent use of a Simulated Trading Room across a range of finance subjects. This facility rapidly became a flagship for the Department’s finance courses, signalling a commitment to high quality teaching with practical application. At Monash, I continued to promote a commitment to the use of simulated trading as an adjunct to teaching. To this end, I obtained two internal grants (in 2006, 2008) at Monash under the Monash University Teaching Grants Scheme (Learning and Teaching Performance Fund) for “A Dealing Room as a Medium for Teaching Finance” (with Kevin Tant and Madhu Veeraraghavan) ($200,000); and “A Simulation Approach for Teaching Finance” (with Madhu Veeraraghavan) ($40,000). I have also been instrumental in furthering the installation and application of the Trading Room at the Monash Sunway campus, Malaysia (visiting the campus to advise and mentor staff on the application and potential of the facility). In Melbourne, I introduced simulated trading notably in Advanced Investments (AFF5040) and MBA Corporate Finance (AFF9005)

An attribute of my teaching derives from my experiences in industry. Thus, in my experiences in the petroleum industry (BP oil company), I was responsible for valuation and investment assessments of the viability of petroleum reserve exploitation, and, thereafter, the evaluation of the optimal development (number of wells to be drilled, etc.) for the reserve. This responsibility incorporated application of such as the net present value method and attendant cost of capital valuation, both of which concepts are taught fundamentally in our units. More qualitatively, I came to understand how investment decisions are actually made in regard to management strategy and corporate politics. This gives my lecturing a sense of street credibility. In addition, my personal awareness of stock market behavior and the vicissitudes of my own investment experiences allow me to illustrate my lectures with anecdotes and personal war stories. Thus, my lectures provide a “value-add” that is more than a mere highlighting of the textbook material.

A further initiative concerned the implementation of a highly student-centred approach to the case-study method in our Masters programmes as pioneered at the Darden School of Business (University of Virginia), in which students having studied the case-study are assessed by their contribution to in-class discussions.

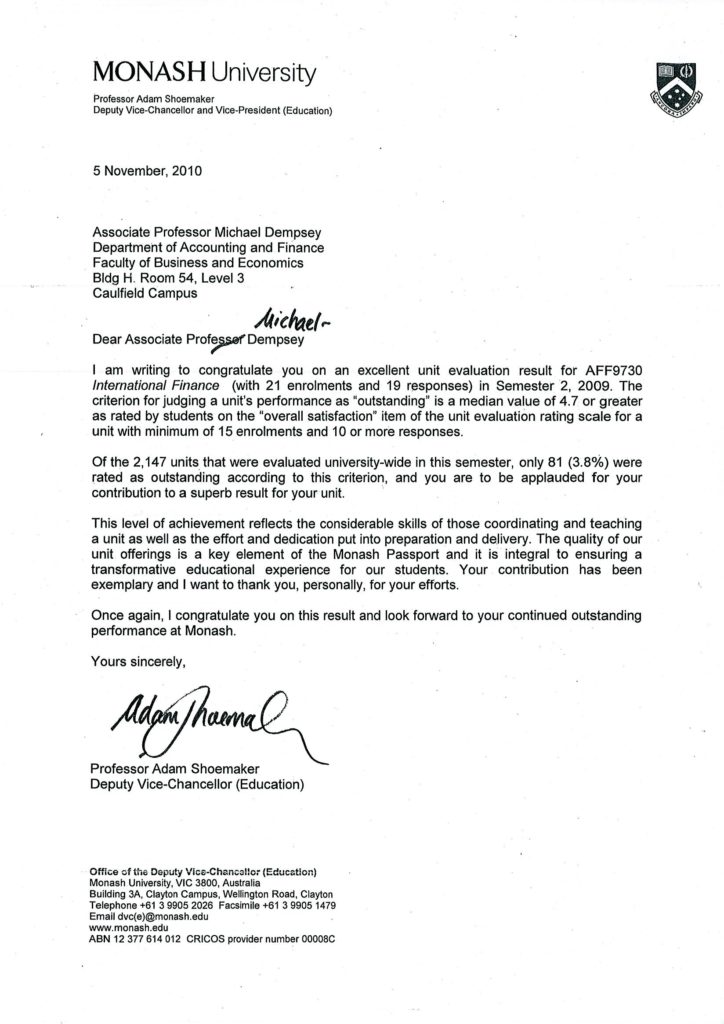

I have supervised 6 PhD students to completion, and typically am engaged in supervising either two or three PhD students each year. I have a distinguished record as a university lecturer, consistently scoring excellent student evaluations and positive comments in university teaching questionnaires. I have received a letter of commendation from the Deputy Vice-Chancellor of Education for excellent students’ teaching evaluations.

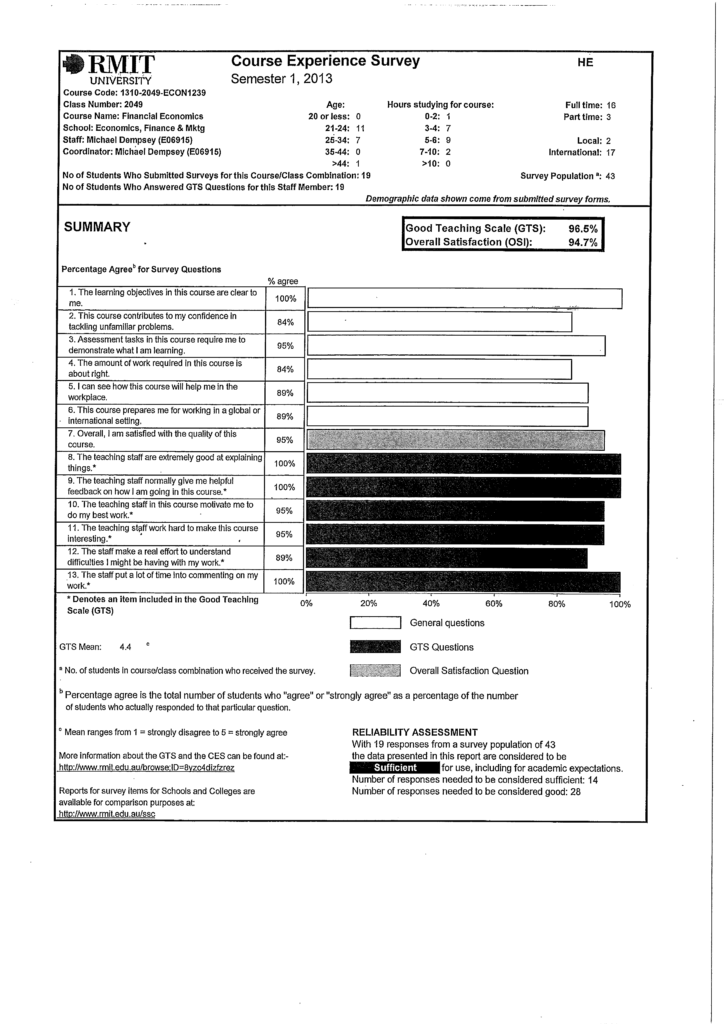

See Appendix for student responses to my courses:

Good teaching Scale (GTS): 90% plus

Overall Satisfaction (OSI) : 90% plus

Summary of Outstanding Achievements in Service

At present, I am the Leader of the Finance Discipline at the School of Economics, Finance and Marketing at RMIT. Responsibilities are for the well-being, motivation and management of the Finance member generally. In addition, I am now assuming responsibility for time-tabling of Finance courses at under- and post-graduate levels.

Previous posts of significant importance held at Monash University:

- Director of the Master for Applied Finance and Master of Business (Banking and Finance) programmes:

In this role, I dramatically re-designed the structure of the Master of Applied Finance in response to student expectations (for more electives and improved progression and co-ordination of their studies). I was also responsible for directing changes to the programme aimed at compliance with AACSB (The Association to Advance Collegiate Schools for Business) accreditation (directing lecturers to demonstrate compliance with the Association’s criteria, such as, demonstrating ‘assurance of learning’).

- Higher Degrees and PhD Coordinator (responsible during the six-month OSP of the Coordinator):

This is a demanding role, including responsibilities for assessment of higher degree applications and making acceptances and offers of scholarships to chosen applicants; chairing of all Departmental PhD ‘confirmation’ seminars; as well as representing the concerns of the Department’s higher degree students at the Faculty Research Degrees Committees.

- In addition, as a team-player in the Department, I have assumed responsibilities as a member of the Honours Committee; a member of the Staff Selection Interviewing Committee (short-listing and interviewing committees for advertised posts of Senior Lecturer/ Lecturer/ Assistant Lecturer); as well as Performance Manager for junior members of the Department.

Short Summary of Industry experience prior to joining Academia.

British National Oil Corporation (BNOC), Glasgow: 1979-1981: Reservoir engineer for Thistle and Clyde oil fields: responsible for input of all parameters for Clyde, including water injection feasibility studies.

ARAMCO, Saudi Arabia: 1981-1983: Production Engineer for water injection: installations and oil production facilities at the Udailiyah complex (monitoring and reporting for all wells).

BP Oil Company, London, Cairo, Aberdeen, Qatar, The Hague: 1983-1990:

BP London office (1983-1987 & 1989-1990): Reservoir engineer conducting reservoir rock and fluid characterizations, material balance evaluations and reservoir simulation studies using Eclipse for the assessment of production potentials under various scenarios.

BP Cairo Office (1988-1989): Reservoir engineer performing reservoir performance evaluations, reserves estimates, pressure transient test designs and interpretation, and assessment of drilling and completions.

Short-term assignments at BP Oil Company:

BP Aberdeen (1983): Designed and conducted North Sea exploration well tests.

BP The Hague (1987): Assessment of problematical well tests.

BP Qatar (1990): Performed integrated study of Dukan well performances.

Appendix: Best teaching scores

I have merited a letter of congratulation from the Deputy Vice-chancellor (Education) at Monash University, Adam Shoemaker:

Course Experience Survey, RMIT Semester 1, 2013